Support Our Cause

Ways to give back

There are so many fun ways to give! You can become a monthly donor, shop from our AmazonSmile Wishlist and have items delivered right to our door, send a check in the mail, make in-kind donations, and so much more! Your support makes a big difference!

GIVE ONLINE

Give quickly, conveniently, and securely to A Child’s Haven through our online payment portal.

GIVE MONTHLY

Become a “Life Lifter”. Your monthly gift will help provide our children life-changing therapeutic child care, transportation to and from treatment, healthy meals, and much more.

GIVE CASH OR CHECK

If you’d like to donate by cash or check, you can drop it off at our facility or mail it to:

20 Martin Drive

Greenville, SC 29617

GIVE IN KIND

Supplies and equipment help us maintain our daily operations and provide resources to our families.

LEAVE A LEGACY

Each year many people choose to review their long-range estate and financial plans. Many leave a legacy through wills, life insurance policies, and retirement accounts.

APPRECIATED ASSETS

Appreciated stock may offer significant tax savings. You avoid capital gain taxes and receive a tax deduction for the value of the stock on the date of transfer.

IRA CONTRIBUTION

If you are over 70, you may make a direct distribution from your Individual Retirement Account up to $100,000 in a calendar year. This distribution will satisfy your RMD.

SHOP WITH AMAZON SMILE

Amazon gives 0.5% of the price of your eligible AmazonSmile purchase to A Child’s Haven. Simply follow the link to get started!

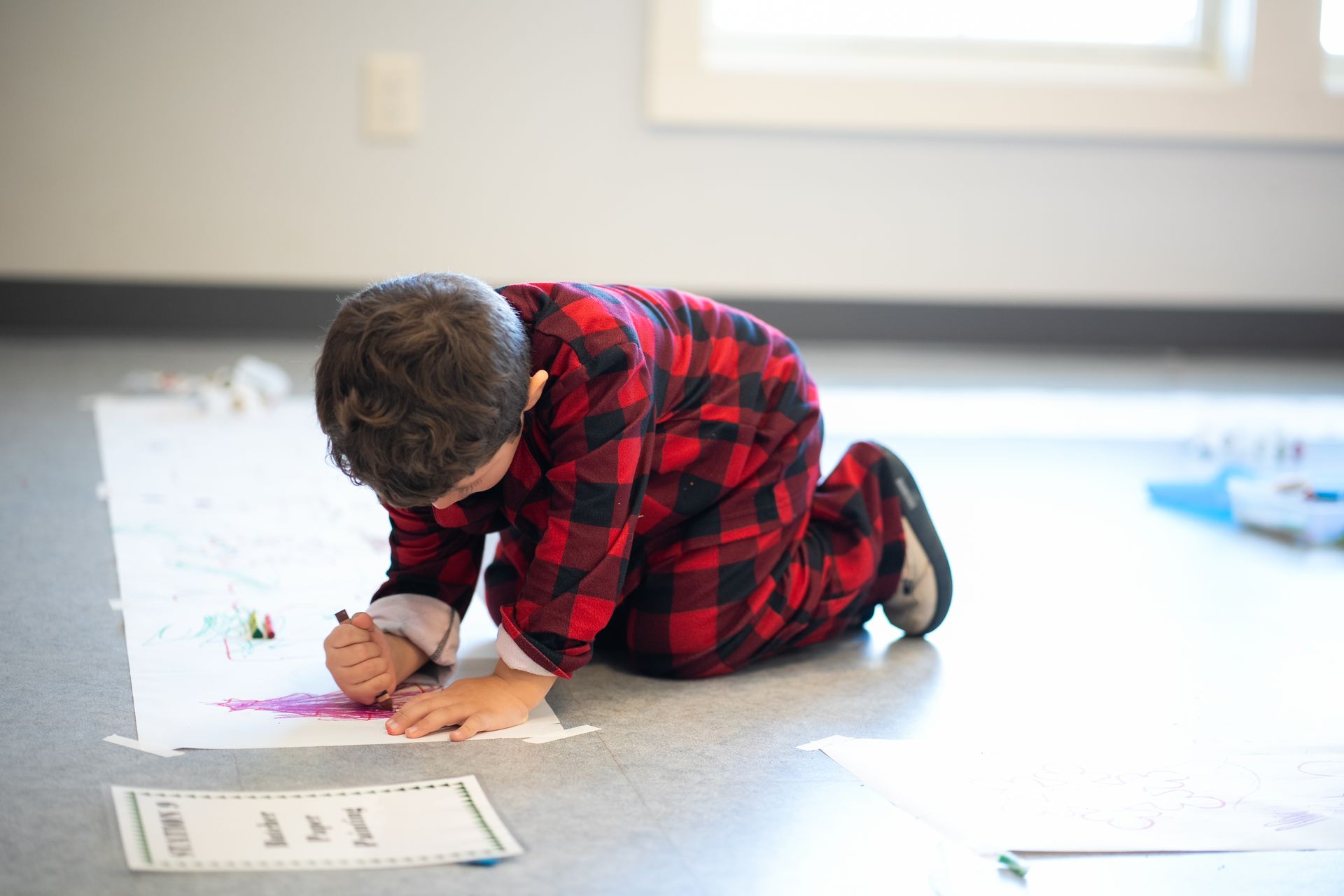

Contribute to a child's success, invest in your community's future

Research has shown that for every $1 spent on programs like A Child’s Haven, $13 is returned to the public treasury. This is possible because of a reduced need for juvenile and adult programs, and an increased contribution of each person to his or her community.

Think about your own childhood. What difference would it have made if someone invested in making your life richer? A gift to A Child’s Haven not only demonstrates your belief in our mission, but also reinforces your commitment to making a difference in the world.